Bay Area - Fremont California

Transit Oriented Office and Multifamily

110,000 SF Existing Office Building

with Approvals for an Additional 150,000 SF

The Opportunity:

- Purchase a Positive Cash Flowing, 100% Leased Up Asset at a 6.9 CAP

- The Acquisition includes an additional 3 acres that are ENTITLED for an additional 148,000 square feet that could be developed as a multifamily project

Project Summary:

This project is:

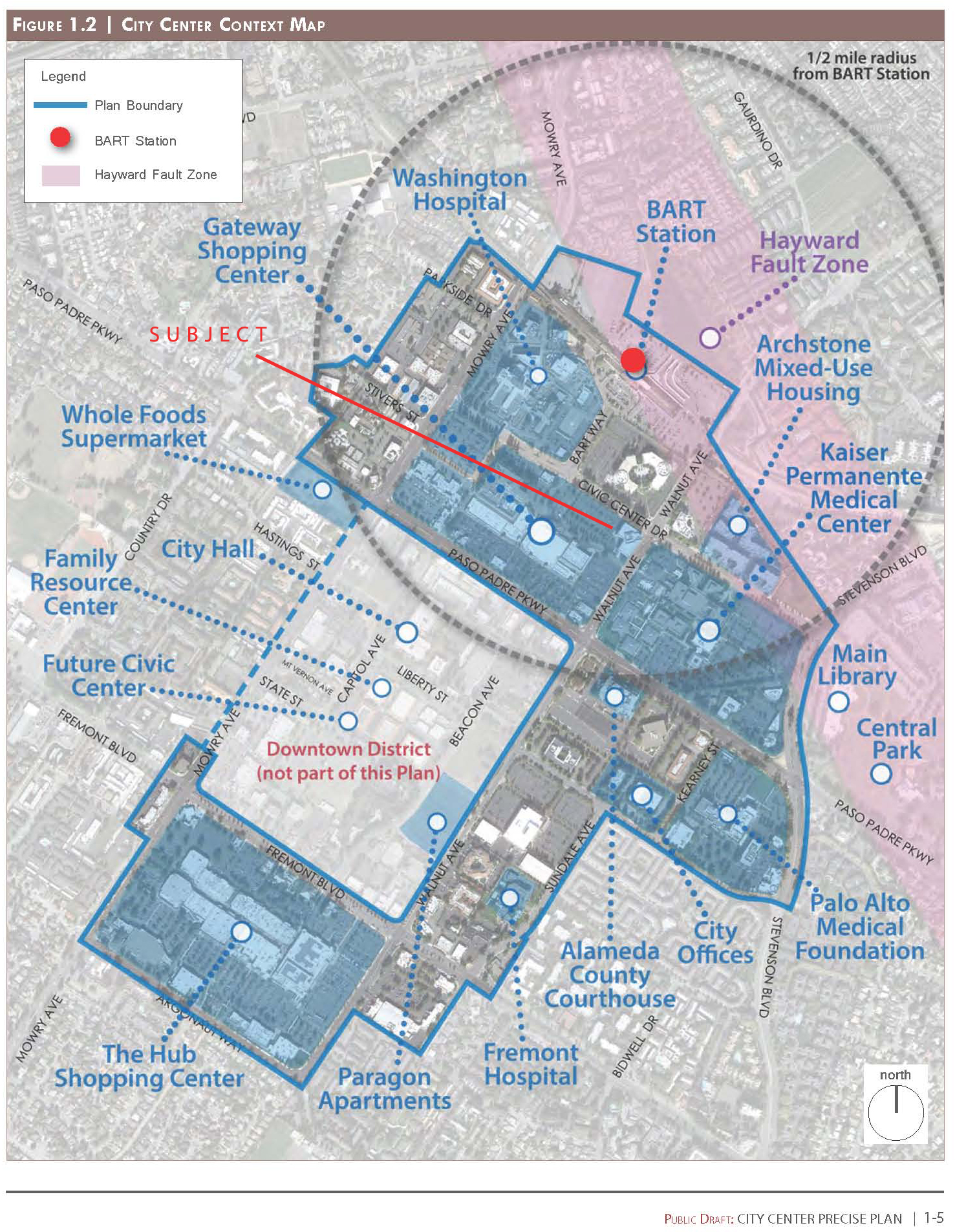

- In a Bay Area location;

- It is just a couple of blocks from a BART station;

- Adjacent to a primary shopping and entertainment center

- Within a block of a regional Hospital and surrounded by the public and private support support services.

- Has a NOI of $2,448,000 for 2013 and the last vacant space is being leased so the project is 100% leased with a projected NOI for 2014 of $2,598,631.;

- Has a bank occupying 10% of the space and government offices occupying 65% of the space;

- Some of the government leases go until 2020

- The site is entitled for an additional 150,000 square feet of development;

- This asset is not on the market;

- It can be purchased at a 6.9 CAP plus small bonus for Additional Entitled Land.

Business Plan:

Key Points:

- Purchase Price $39,000,000

- Due Dilgence 45 Days

- Closing Scheduled _ 30 days after due diligence

The purchase price of this asset is based on buying an existing Class A office building that a Wells Fargo Bank as a tenant. Constisting of 3.92 acres, the office building sits on approximately 1 acre. The remaining 2.9 acres is entitled for an 148,000 square feet of development plust a parking structure

The asset could be purchased with Three Possible Business Strategies:

- Continue to operate "As Is". Effectively treating the purchase as a core asset for the NOI;

- Purchase with the intention of adding value by developing another office building of up to 150,000 ssquare feet;

- Purchase with the intention of adding value by developing a multifmaily project of +/- 160 units.

Alternative Exit Strategies would include:

- Once the multifamily plans are approved, sell that portion of the project to another developer; or

- Retain the multifamily asset and sell the office asset; or

- Build a condo project rather than an apartment project; or

- Build an apartment project and convert to condos at a later date.

Acquisition Information:

- Property Summary Report

- Rent Roll

- Lease Abstracts

- CAM Costs

- CAM Reconciliation

- Entitlement Documents (availalbe upon request)

- Proposed Development Site Plan

- Proposed Development Elevations

- Proforma for the Office Asset in Argus DCF format, projecting 10 years based on lease abstracts.

- Proforma for the Office Asset in Argus Developler format, projecting 7 years as stand-alone component of the development

- Proforma for the Mutilfamily Development, projecting 7 years as a stand-alone compponent of the development

- Proforma for the COMBINED multifmaily development and exisitng office asset

- Printable Executive Summary

VALUATION

Office Building: Our Argus financial model shows the current asset is worth $39,000,000 based on this 2014’s NOI of $2,598,631 at a 6.65 CAP. An alternative perspective on value is $39,000,000 based on a NOI of $2,598,631 at a 6.9 CAP ($37,661,318) plus a bonus payment to the seller for the additional entitled land.

- An audit of the current long term leases show they escalate at an average of 4.9% per year over the next 9 years enhancing the projects future value at disposal;

- Our financial model shows:

- a Project IRR of 18.66%, Equity 19.12%

- a Project Multiple of 2.65

Apartment Development: If the apartment development is added the project values greatly improve. The apartment project as a stand-alone asset is a very profitable venture in the highly desired Bay Area market.

Our Financial models suggests a 72 month multifamily development project would:

- Have a Project IRR of 15.66%, and an equity IRR of 25.1%.

-

The equity IRR is higher than typically seen because we assume the initial purchase equity is all allocated to the office, no upfront land expense burdens the apartment development IRR.

In this scenario the apartment builds a parking structure that accommodates the office parking need.

- A Project Multiple of 2.42

Either asset could be retained long term or sold separately.

Combined Asset Performance: Our modeling has looked at the results if both assets are sold in month 72 (fall of 2020). The combined performance we see is:

- 1. A project IRR of 17.08%, The combined equity IRR of 21.55%

- A project Multiple of 2.52

Buyer / Investor must rely on its own Due Dilligence

FINANCIAL ASSUMPTIONS

Existing Office Building Acquisition:

| No. | Item | Desc. | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Acquisition: | $39,000,000 (based on a 6.9 CAP of $2,598,631 2014 NOI) | ||||||||||||||

| 2. | NOI |

|

||||||||||||||

| 3. | Revenue | $70,193,000 total revenue is comprised of $52,877,000 in CAP Sales Revenue and $17,316,000 Cash Flow from leasing | ||||||||||||||

| 4. | Total project costs: | $49,412,000 (including brokerage and closing cost when we sell) | ||||||||||||||

| 5. | Profit: | $20,780,000 | ||||||||||||||

| 6. | Construction Debt: | $0 | ||||||||||||||

| 7. | Total Equity: | $12,632,000 | ||||||||||||||

| 8. | Mortgage | $26,000,000 | ||||||||||||||

| 9. | Equity IRR & Multiple | 18.66 & 2.6 |

Apartment Development:

| No. | Item | Desc. |

|---|---|---|

| 1 | Acquisition: | $0: Purchase price of building is based on NOI. This asset takes on the cost of building a new parking structure for both assets. |

| 2. | Revenue | $74,002,000 total revenue is comprised of $64,500,000 in CAP Sales Revenue and $9,502,000 Cash Flow from leasing |

| 3. | Total project costs: | $54,268,000 (including brokerage and closing cost when we sell) |

| 4 | Profit: | $19,734,000 |

| 5. | Construction Debt: | $29,815,000 |

| 6. | Total Equity: | $13,880,000 |

| 8. | Mortgage | $38,380,000 |

| 9. | Equity IRR & Multiple | 25.1 & 2.42 |

Combined:

| No. | Item | Desc. |

|---|---|---|

| 1. | Acquisition: | 39,000,000 |

| 2. | Revenue | $144,196,000 total revenue is comprised of $117,377,000 in CAP Sales Revenue and $26,818,000 Cash Flow from leasing |

| 3. | Total project costs: | $103,680,000 (including brokerage and closing cost when we sell) |

| 4. | Profit: | $40,515,000 |

| 5. | Construction Debt: | $29,815,000 |

| 6. | Total Equity | $25,249,000 |

| 7. | Mortgage | $64,380,000 ($26,000,000 to purchase Office, $38,380,000 for apartments after stabilized) |

| 8. | Equity IRR & Multiple | $21.55 & 2.56 |

TIMING

This is an unlisted opportunity. We have been told the seller will accept a price based on the previously mentioned 6.9 CAP. He is seeking buyers and plans on selecting a buyer no later than June 30th.

We have been told we have he has a $35,000,000 offer that is based on a 30 Due Diligence and 10 day close that he is giving serious consideration to.

If we close in the third quarter of 2014 we should be in a position to start construction on the apartment development in the fourth quarter of 2015.

We suggest the appropriate duration of the project to be 72 months to maximize the IRR potential of the investment. However the office is stabilized, and the Apartment Stabilization is achieved around month 42.

RELATIONSHIP